How to Create a Wedding Budget

In our grandparents’ day, marriage began with a small ceremony, complete with the church organist banging out “Canon in D” (you know it as that fancy wedding song), and maybe a potluck to celebrate. But today, marriage begins with more . . . everything. In fact, it’s a giant to-do—which comes with a giant to-do list.

Far from a chore, though, your wedding is one of the most memorable and special days of your life! But where do you begin? With the wedding budget! (Always with the budget.)

Let’s walk through how to create a wedding budget that marries your dreams and your bank account and helps you keep both on the path to happily ever after.

- Four Steps to Take Before You Start Planning Your Wedding (and Wedding Budget)

- What Are Your Main Wedding Budget Categories?

- Final Ways to Save Money on Your Wedding

Four Steps to Take Before You Start Planning Your Wedding (and Wedding Budget)

Step 1: Determine the type of wedding you want.

Are we talking indoor, outdoor, destination, church, old train station, castle on the coast, White Castle? If you’re having trouble deciding, start with your guest list. That number could help you pick a location. You can’t fit 500 friends and family members in a woodland treehouse wedding.

Ready to start saving? Get started with a free trial of Ramsey+ today.

Of course, one of the quickest ways to save money is to limit your guest list. But maybe tons of people celebrating your big day is your number one wedding wish. That brings us to the next point.

Step 2: Resolve your nonnegotiables.

As a couple, determine what you want out of your wedding day. What are your top three most important wedding dreams? Food, flowers and filmography? Live band, location and lavender tuxedos?

Hey, before you say “I do” to the rest of your lives together, you’ve got a lot of other I dos to figure out: I do want the chocolate-ganache-covered cake with fondant orchids, for example.

After you pick your top three, think about what’s not important. Keep your most and least valuable dreams at the top of your minds as you begin to take the third, and biggest, step.

Step 3: Budget for the wedding of your affordable dreams.

Does that sound sort of . . . um . . . unromantic? It shouldn’t!

Starting a life together is beautiful. But starting the union off by draining a savings account or going into debt to impress yourself, your friends or your family—now that’s unromantic. Instead, give your wedding budget a realistic number that you can afford while covering everything you want out of your big day.

Step 4: Have the budget talk with family.

In the past, etiquette told us exactly what roles the parents of the bride and groom played—including who paid for what. But this is 2021.

Maybe it’s because couples wait later to marry (the average age people get married now is 32) and they’re expected to have their personal finances in a decent place. Whatever the reason, the average couple pays for about half of the wedding cost these days. How are they paying? Well, couples use savings (45%), cash (38%), checking account (37%), and credit cards (32%), or some combination of those.1

You’ll need to have a conversation with your parents about their role in your wedding. And remember, they don’t owe you anything here. But if they’re willing to help out, it’s good to know how much they want to contribute.

It may help to know what couples spend on average as you shape your budget. We’ll start with the total: The average wedding (including honeymoon and engagement ring) costs $38,900.2 That’s a whole lot of money.

If $38,900 sounds like a solid investment to you, then keep reading. You’ll see how to put all that to the best use. If $38,900 sounds impossible, keep reading. We’ll share plenty of tips to show you how to have a sensational celebration for less.

That’s right! This is wedding budget central. We’re going to break down each common category in the wedding budget, talk about averages, and give tips on how to save. Are you ready? Cue that “Canon in D.” Here we go.

What Are Your Main Wedding Budget Categories?

On average, 60% of couples increase their initial budget—mostly because they either get caught up in things they feel they can’t live without or their first budget was unrealistic.3 That means they must suddenly scramble to find money they weren’t planning to spend in the first place.

Don’t let this be you! Prep now so you don’t pay more later. As you start to account for all the dollar amounts, you can use our EveryDollar Wedding Budget Worksheet to write down planned amounts, track spending, and keep up with your final totals. It divides your spending into the main categories below:

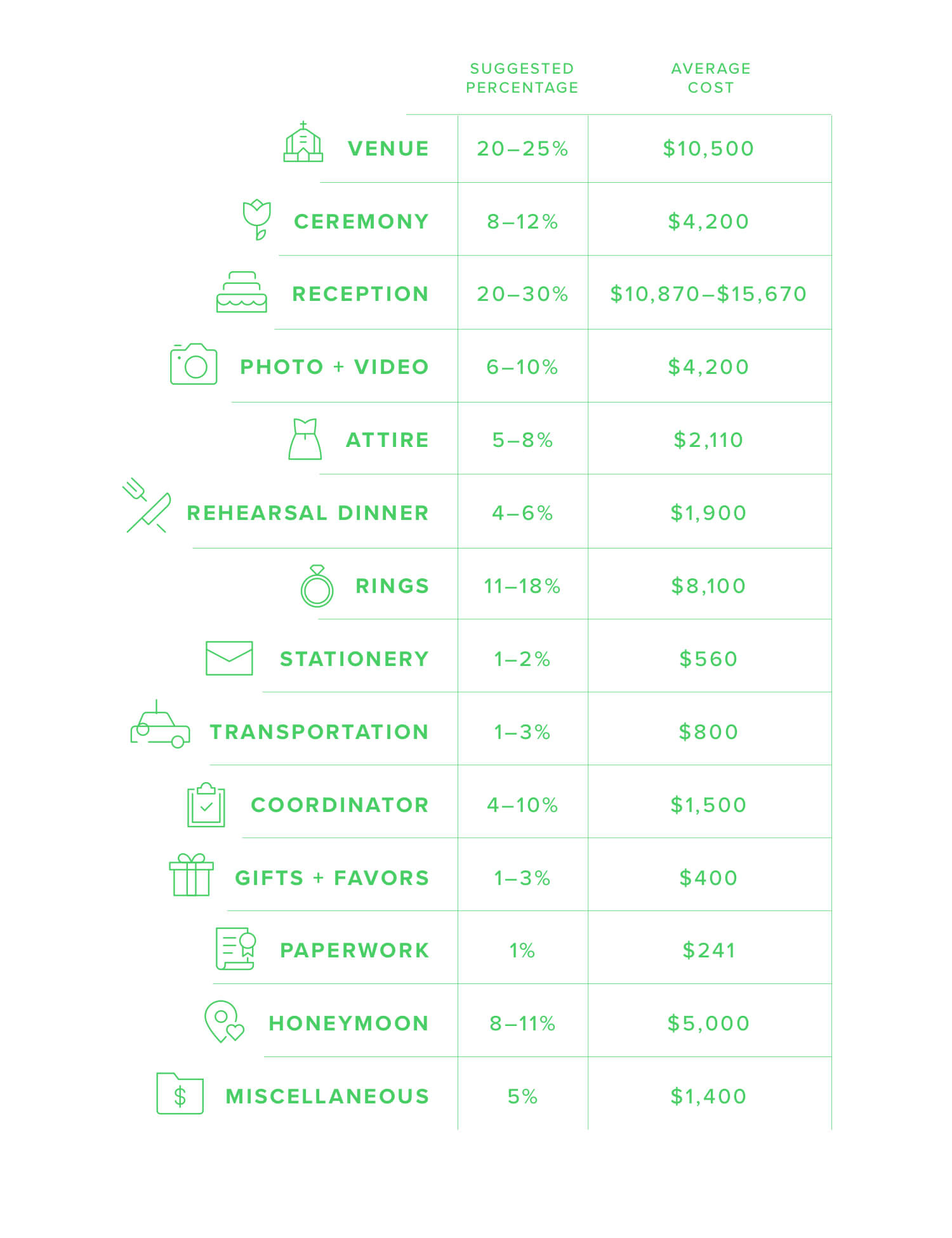

We’re going to break down each of these, sharing even more average costs and some tips on how to save on your wedding. Remember your nonnegotiables as you read. And keep in mind you don’t have to spend the average amount we listed. Plan to spend more if something is top priority, and budget less on things that aren’t as important to you.

And remember that you don’t have anything to prove to anyone at your wedding. That is absolutely not what this is all about!

Are you ready to set a budget you can both have and hold? Let’s get started.

Venue Costs

Average Cost: $10,500 Suggested Budget Percent: 20–25%

Location

The venue tends to be the first thing couples search for. It is, after all, where the magic happens! In fact, 57% of couples talk about venue type before they even get engaged. How much do couples usually spend here? It’s often the big-ticket item in your wedding budget: The location of the ceremony and reception takes up about $10,500 of the average budget.4

You probably won’t be surprised to hear COVID-19 boosted the amount of outdoor ceremonies to 68% and receptions to 59%. Also, all the pivots and restrictions made hometown weddings the most popular (at 60%) and barn or farm venues the most used reception locations for 2020.5

When you’re booking your venue, think about how the month and date of your wedding will affect the location’s cost. Spring weddings used to be all the rage, with pastel pantsuits a plenty, but that trend has been taken over. Fall now ranks at the most popular season for ceremonies, with October as the most popular month.6

Busy venues know they can charge more when their services are most desired. If you’re willing to get married in December or January, the two least popular months for weddings, you should look or ask for a discount.7 Your dream venue wants your money in non-peak months, and you want your dream venue. It could be a win-win for both of you.

The weekends make for the busiest wedding days. Changing the day of the week could mean lower costs. But you’ll have to remember that weeknight weddings might make it difficult for guests (especially traveling ones) to attend, so you might see a lot more “declines with regrets” on those RSVP cards. It also means extra days off work if you need to prep anything beforehand. So, weight the pros and cons of this one.

Wedding Ceremony Costs

Average Cost: $4,200 Suggested Budget Percent: 8–12%

Officiant

Find out what your state requires to make your marriage official. If you hope for a friend or family member to perform your nuptials, it may be possible. Just know your guidelines.

And while some officiants charge and some do not (the average cost being $250), cash or a small thank-you gift is always a good idea.8 After all, their signature will sit on your marriage license for all time.

Music

Ceremonial tunes average $450.9 If having a four-string quartet is key to making your wedding dreams come true, you’ll might pay even more for that.

But what about all those super talented friends you have? The ones who could have a music career if they applied themselves and knew the right people? Yes. Them. What if you asked them to perform your favorite love songs?

How personal would it be if the processional was the first song you two held hands to—sung by your college roommate? Not the tone-deaf one—the one who can belt it out like Christina Aguilera. You could save money and create a more meaningful moment.

Flowers, Lighting and Decor

Flowers, lighting and other decor for the wedding day run an average of $3,500 (ceremony and reception combined).10 That’s a lot of petals, twinkle lights and tulle. Some venues have enough charm on their own, but most couples like to spruce up the place and add personal touches.

If you’re limiting your spending in this category, think about what will show in photos during the ceremony. A wooden arch decorated with greenery and flowers to frame the happy couple is probably a better investment than elaborate centerpieces. That arch will set a scene that you’ll show your great-grandchildren one day when you flip through the photo album, while the centerpieces are just wow factor for the day.

Keep in mind that decor isn’t the only place you’ll need flowers. Most weddings include bouquets, corsages and boutonnieres. And you might also want a flower girl to sprinkle rose petals down the aisle. That costs money. And if you’ve always dreamed of hydrangeas, calla lilies or tulips for the bouquets, be aware that these spring and summer blossoms will come at a high price if you’re having a winter wedding.

But maybe the guys don’t want boutonnieres—that’s a good place to save money. This category is also a great place to get your DIY on! You don’t even need a florist: Check out the floral department at your local warehouse store or even supermarket.

With any wedding project you want to take on, remember to consider the cost of supplies and how stressed you’ll get making it happen. Be sure to make everything far enough ahead of time so you aren’t hot-gluing paper petals (made from the sheet music of your favorite Beatles love song) into an elaborate bouquet the night before you wed. No one wants tired eyes and burned fingers in their wedding photos!

Reception

Average Cost: $10,870–15,670 Suggested Budget Percent: 20–30%

Catering

We mentioned before that the venue is the most expensive item in most wedding budgets. And coming in second place is . . . drumroll please . . . oh, you probably guessed it: food. Catering costs come up to about $70 a guest—and average guest lists are 131 people. Math that out, and you get $9,170.11

So, if you subtract the price of the engagement ring and honeymoon (which we’ll discuss later) from the average wedding cost, that means you, your family, and your friends will be eating over 32% of your wedding budget (and that’s not even counting the cake!).

That also means food is a fantastic place to get frugal. If you’re wanting a full meal, you can trade the sit-down, plated, four-course option for buffet style. This was a pretty popular trend pre-COVID.

In 2020, 54% of couples made food adjustments to make their guests feel safer, like individual hors d’oeuvres.12 With things slowly getting back to somewhat normal, figure out what food situation works best for your budget and your level of comfort here.

Having an earlier ceremony with a lunch reception is another great way to save on your food budget. Maybe a midday meal is the way for you. If you want to save even more, offer just appetizers, dessert or both!

Note that some venues may have their own catering or have an agreement with another company. An all-inclusive event space could save you money and time, so don’t rule it out until you compare prices!

The Cake

Speaking of dessert—let them eat cake! After all, according to Julia Child, a party without a cake is just a meeting. Do you want to join the 83% of couples who have a cake-cutting ceremony?13 Or maybe you just want to have cupcakes? A donut wall? Milk and cookies? We won’t tell Julia Child if you break from tradition.

But since love is sweet, offering some kind of sweet is, well, sweet. The average spent here is $500, but you can totally save money by offering an assortment of homemade treats versus a traditional three-tier wedding cake.14

Flowers and Decor

We won’t highlight the costs of this category again, because we covered that under the venue section—but couples often decorate the ceremony and reception locations.

You can save money here by asking a couple of groomsmen to move some decorations (and even chairs) from the ceremony spot to the reception venue.

You can also consider renting, purchasing pre-loved decor from online marketplaces like Facebook or Etsy, or buying things you could use in your home or as gifts to people after the wedding is over.

Music

Peace and quiet is a goal of retirement, not your wedding reception. You need music. And if you’re the type of couple whose relationship started on a shared love of music, we bet you made the jams at your reception one of your top three priority spending nonnegotiables.

A live band can cost $3,700. You could also hire a DJ if you want classic and modern hits to get people dancing. That costs far less at $1,200.15

Both create a completely different ambiance—so once you figure out what you want, hire what you need. And if you want to get really thrifty, consider creating your own playlist and plugging into your venue’s sound system. Then you won’t have to worry about “YMCA” playing (unless you want it to).

Beverages

Beverages are a must. If your wedding is more DIY and thrifty, you can go the water, soda, iced tea direction. One step up would be offering your favorite beer and wine or having champagne just for a toast. This can make it all feel more personal and save you from having to offer an open bar—something 78% of couples do (and that’s included in some venue or catering packages). If you do want to budget for an open bar, go for it! Just know it can get you to the $2,300 average spent on alcohol and liquor real quick.16

You don’t want to leave your guests thirsty, but what you offer should be far more about the vibe you want and the budget you’ve got.

Photography and Videography Costs

Average Cost: $4,200 Suggested Budget Percent: 6–10%

Engagement Photos

He said, “Will you?” She said, “Yes!” Now it’s time to make the announcement. What better way than with engagement photos? In fact, many guys think even further ahead and hire someone to film or photograph the moment they pop the question!

When you’re searching for the perfect wedding photographer, consider one who includes engagement photos in their wedding packages. It’s a great way for the photographer to get to know you as a couple, as well as learn what you want from photos before the big day.

Ceremony and Reception Photos

You obviously want the actual ceremony photographed. From the walk down the aisle to the groom’s face as he sees his bride to the first kiss as husband and wife—all of these moments need to be captured.

Many couples pay to have the reception photographed as well, or at least portions of it. And because these photos last a lifetime, the photographer is usually the fourth highest expense at $2,400.17

To make sure you get the most memories captured for your money, carefully look over package options. Some photographers work by the hour, which means you’ll want to have a list ready with all the family and wedding party pictures you want.

The photography assistant, your wedding planner, or a no-nonsense friend can keep everyone moving in a timely manner from one shot to the next. Whether or not your photographer is hourly, you don’t want a frustratingly slow photography process. You’ve got the wedding or reception to get to!

Videography

Not only do you want still shots of your wedding moments, you probably want your ceremony (and maybe the reception) filmed too. Whether you’re looking for a basic recording of the event or an elaborate movie-like experience, videography is a hot-ticket item these days, averaging $1,800.18

Photo Booths

Photo booths at weddings are becoming incredibly popular. These generate entertainment for your guests, up the numbers on your wedding hashtag, and offer a free (to them) memory for friends and family. You can save money by using a camera that emails or texts images rather than printing them.

Save even more by not offering this at all. Or maybe just set up a playful background as a selfie station with props and decor so your guests can use their phones to fill their social media accounts.

A photo booth isn’t a necessity, so don’t blow your wedding budget here. But it’s a fun addition if you’ve got the funds.

Attire Expenses

Average Cost: $2,110 Suggested Budget Percent: 5–8%

The Wedding Dress

What’s a wedding without a wedding dress? Shopping for this gown is a huge moment in a girl’s life. In fact, 54% of brides try on about six dresses before they find “the one” they say yes to. And how much does that yes cost? An average of $1,600.20

Some of you nodded your head at how reasonable that number seems. Some of you did a literal spit take with whatever you’re sipping on as you read this.

The dress is important. Seriously. As we said before, the photographs last forever, and guess what you’re wearing in those photos? Your wedding dress. But you might be surprised at how you can rival the beauty of the royals for way less.

Don’t feel stuck going to bridal shops. Any formalwear store will have options in white. Look online or go to consignment stores for used dresses, either from unsentimental or runaway brides. If that feels weird, look for vintage dresses on Etsy.

The dress isn’t all the bride needs to think about. Veil or no veil? Converse or couture heels? Pearls or diamonds? (Jewelry is about a $200 expense, by the way. Don’t forget to budget for that too.)21

Remember, not everything has to be brand-new. Maybe you buy the dress but wear your mom’s veil and his grandmother’s jewelry.

Let your style that day reflect who you are—and what your budget allows.

Bridesmaids Dresses

Oh, bridesmaid dresses. They were once notorious for being ugly. Thank goodness that trend is pretty much over.

Who pays for the thing? Usually bridesmaids buy their own dresses (the average cost is $140 these days), though some brides have been known to make it a gift.19

Brides, can we suggest a few budget-friendly (and friend-friendly) tips here? Find a way for the dress to be something they can wear again!

Maybe you can pick out the color scheme and let them pick their own (reviewed and approved by you) dress. This helps their budget all around but still gives you a final say in the overall look for your big day.

Beauty Services

Beauty services can range from having hair, nails and makeup done to far more complex beauty rituals. Brides spend an average of $110 on their hair and $100 on makeup for the big day.22

We understand that if you have two left hands and can’t even get your hair into a ponytail or draw a straight line with eyeliner, you probably need some professional help getting picture perfect.

Or do you? What about that friend who has a knack for painting nails or the cousin who does hair for fun?

We said it before, and we’ll say it again (probably again and again): Ask those friends who are talented to share their talents for a discounted price or instead of giving you a gift.

Attire for the Groom and the Groom’s Party

It’s time to suit up. Or tux up. That’s one of the first decisions. Whichever you pick, remember the groomsmen usually pay for their attire (which can be around $180), so don’t make them get decked out in tails, silk bow ties, ruffle shirts, top hats and canes.23 All that costs extra (for you if you cover the bill for the groomsmen, or for them if you don’t).

What about the groom himself? Are you going tux or suit? The average spent here is about $300—and remember the benefit of going the suit route is buying something you can use again.24 But a tux . . . you’re probably not going to need that thing again, unless you want to dress up at Mr. Peanut for Halloween.

Rehearsal Dinner

Average Cost: $1,900 Suggested Budget Percent: 4–6%

The night before the wedding, the couple, family and wedding party generally do a run-through finished off with a rehearsal dinner. The cost of this prewedding event is about $1,900.25 That can cover the food, venue and beverages.

Some venues will cover location and food, and some need a separate caterer brought in. Don’t forget the power of someone’s house, your friend’s backyard, or your church’s fellowship hall and loads of BBQ for this evening together. You’ll still have a good time without the expenses racking up.

Wedding Bands

Average Cost: $8,100 Suggested Budget Percent: 11–18%

Engagement Ring

What do you think the average engagement ring costs? Go ahead and guess.

Ready for the answer? $5,900.26

We’re not here to tell you what you can and cannot spend on a piece of jewelry that goes along with one of the biggest questions you’ll ask in your entire life. But keep two things in mind when you’re opening that ring box to the words, “Will you marry me?”

- Do not go into debt to buy an engagement ring. Set a budget, start a fund, and save up cash. You’re supposed to be walking into a shared financial future together: Don’t start on the wrong . . . knee.

- Remember the proposal is about marriage—a life together—not a ring.

Wedding Rings

The exchange of wedding bands is part of the ceremony. His and her rings average $2,200.27 Many people look for bands that coordinate with her engagement ring, but this doesn’t have to be the case. Get something that suits your personality. That doesn’t have to be pricey platinum or a gold band.

Silicone rings are on the rise. These bands began as a safer option as they are easy to remove in case of an accident, but they’ve become popular with people who work out, work with their hands, or work in dangerous career lines such as firefighters or police officers. This isn’t the only nontraditional option for couples. Shop around.

Stationary

Average Cost: $560 Suggested Budget Percent: 1–2%

Save the Date

Save-the-date announcements feel like a must these days (either because of everyone’s incredibly busy lifestyles or incredibly clever marketing from the paper companies). While it’s great to get your ceremony on everyone’s calendar, you don’t have to spend money here.

You could send an email and maybe add the link to your wedding website—if you’re one of the 79% of couples who create a website to share details about your big day with your guests.28 Or have your mom call everyone. You know she wants to anyway.

Wedding Invitations

Invitations, with RSVP cards included, are the next stationery expense. And don’t forget the stamps, both for what you send out and what comes back. It’s quite common for the RSVP envelopes to be labeled with your address and a stamp for convenience. You could save money here by skipping the reply cards and asking for text or online responses.

You can make the invitation lovely and fit your style without spending a ton of money. Remember, except for your grandparents, parents and BFF, no one keeps these.

Printed programs sharing the day’s schedule aren’t as common these days—you’re more likely to see a hand-lettered wooden pallet or chalkboard. Again, if you’ve got a friend with those skills, call in a favor, and save on paper.

Thank-You Cards

The final paper you need to worry about are the thank-you cards—which call for more stamps. Of course, you can share a verbal thanks, send an email, or give a social media shout-out. But nothing compares to physical, handwritten thank-you cards to people who spent their time and money to congratulate and celebrate your love.

You don’t need to spend hundreds of dollars on cards that match your invitations. You can save money by going to a dollar store and grabbing a few twelve-packs. Or consider a personalized postcard. It’s the heartfelt thought that counts here, not the cost.

Transportation

Average Cost: $800 Suggested Budget Percent: 1–3%

Hey, you’ve got to get from one spot to another, but you don’t have to take a hit to your wedding budget to show up in style. Of course, if slowly floating down from heaven in a hot air balloon is one of your nonnegotiables, you can just lower your spending somewhere else to afford it all.

In most cases, this transportation line is used for renting a limo or large vehicle to get the couple, the bridal party, or family from one location to the next. But you could always just carpool and save money in this budget line. People probably won’t pay attention to how you arrive. Unless it’s in a hot air balloon. No one’s missing that.

Wedding Planner or Coordinator

Average Cost: $1,500 Suggested Budget Percent: 4–10%

If you’ve got a calendar with each day’s events planned down to the hour, you probably don’t need a wedding coordinator who works out every single detail.

But you might want someone who tells people when and where to go on your actual wedding day—where to get their pictures taken, when to begin walking down the aisle, when to start playing “I Feel Good” by James Brown at the exact moment you are pronounced husband and wife.

This can be someone you hire to be your day-of coordinator or a well-organized friend or awesome aunt. This category’s a balancing act. You don’t want to spend absurd money for services you don’t need, but the bride and groom shouldn’t be giving anyone tips or direction on their big day!

Gifts and Favors

Average Cost: $400 Suggested Budget Percent: 1–3%

Wedding Party Gifts

A good wedding party does more than stand beside you as you promise forever. They’re there to help when you need them—through planning the event and getting ready. A thank-you present isn’t required, but it is considerate.

Wedding party gifts usually reflect your relationship with the person. Or they can be something to use during the wedding, such as jewelry or a wedding-themed bow tie. This goes for any bridesmaids, groomsmen, flower girls, ring bearers and such.

Wedding Favors

Wedding favors are also quite common but shouldn’t break your bank or become all about showing off to guests or strangers on social media. They’re a token of thanks, a remembrance of the day, a symbol of you as a couple. But also, don’t feel like you have to have a traditional favor, especially if you’re sharing refreshments or a meal with guests.

Paperwork

Average Cost: $241 Suggested Budget Percent: 1%

Marriage License

Here’s a fee many forget to budget in: the marriage license. This formal piece of paper is what makes your marriage legally binding. You need one.

The cost can range from $10 to $115, depending on your state and sometimes even your county.29 In Tennessee, you can get a discount if you complete premarital counseling, even if it’s a free service offered by your minister!

You’ll need to apply for the license a couple days before the wedding—going in together with valid identification. You’re given the paperwork you need to get signed on your wedding day and sent off quickly. You’ll receive an official license in the mail.

But you don’t want just one copy. Order extras! Why? Read on.

Name Change

If you’re one of the 77% who decide to change their last names after getting married, your (paper)work has just begun.30

You’ll need to apply for a new Social Security card (which is free if you go through the Social Security Administration) and passport (around $110). Pro tip on that last one: If your passport is less than a year old, you can get an updated one with your new name at no cost! 31

And don’t forget your driver’s license, which has a different fee depending on what state you’re. Here in Tennessee, the cost is about $16.32

You need to change your name with your bank and job. Oh, and you need an updated library card and gym membership ID—and with all these changes, people want to see a copy of your marriage license. Since you’ll be mailing it off for some of these, it’s easier to have more than one copy (like we said earlier).

It takes time, effort and money to get your name updated on everything, so maybe put on your wedding video in the background to set the mood while you’re sorting through websites and signing checks to one government agency after the other. (Hey. You’re signing your new name. That’s fun!)

Honeymoon

Average Cost: $5,000 Suggested Budget Percent: 8–11%

The honeymoon can range from the ultra-luxurious to the ultra-chill. When you’re planning, think about these three things: your couple personality, your time-off allowed, and your budget. Here are some points to think on while you plan all things honeymoon:

- Do you love to go, go, go and experience new things? You may want to see a new country and party on a cruise (which can actually be as calm or crazy as you want it to be). Are you happiest when you’re together in the quiet? Book a cabin in the woods and bring a stack of books.

- Be reasonable with how much time you take off work. Leave some vacation days open for the rest of the year. You’re a couple now, which means two sets of families to think about for every holiday. Life’s about to get double busy, so don’t use all your paid time off immediately.

- If you don’t have a lot of money to enjoy the vacation of your dreams right after the wedding, it doesn’t mean that day will never come. In fact, we believe it will, as long as you’re willing to get yourself into a good spot with money first.

- Save money on your honeymoon by looking for deals. Stay three nights, get the fourth free. Find midweek or non-peak season specials. In fact, if a particular honeymoon destination is one of your top nonnegotiables, you might want to set your wedding date to line up with making that happen.

Miscellaneous

Average Cost: $1,400 Suggested Budget Percent: 5%

Go ahead and plan 5% of the budget for anything you might forget! If you don’t end up spending this, put it in savings or treat yourself to something extra on the honeymoon.

Here are a few last things you might be thinking about adding to your spending:

- Some couples cover the cost of accommodations for out-of-town guests.

- You might want to book a place to stay the night before and night after your wedding—for you and maybe even your wedding party.

- Although you probably won’t pay for your bachelor or bachelorette party, you might have to pay for travel.

Final Ways to Save Money on Your Wedding

We’ve mentioned some of these throughout, but let’s do a quick roundup of the main ways to save on the wedding—and as a couple in general throughout your marriage to come!

- Ask friends or family to help in place of giving you presents.

- DIY when you can—but make sure you aren’t stressing yourself to the point of not enjoying your big day. And don’t DIY when it would be cheaper in the long run (including time, stress and costs) to hire someone else.

- Don’t book the first vendor you find—for anything! Compare prices and don’t be afraid to negotiate better rates.

- Keep the conversation about money open and be honest throughout planning. Start talking about not only this wedding budget, but how you’ll budget together when two incomes become one as well!

- Take Financial Peace University together. This nine-lesson course will teach you both the basics of personal finance so you can start off on the same page. And you can take it from the comfort of your couch. Lay out the charcuterie. Light a candle. And have nine date nights that will make all the difference in your life together. Check it out exclusively in a Ramsey+ membership—which you can try out in a free trial!

In the end, the best advice we can give, beyond making and keeping your wedding budget, is to remember the wedding is about you—and not about impressing or entertaining others.

Communicate clearly and constantly together about what’s important and what’s not, and you’re on your way to the wedding of your dreams.