How to Cancel a Credit Card

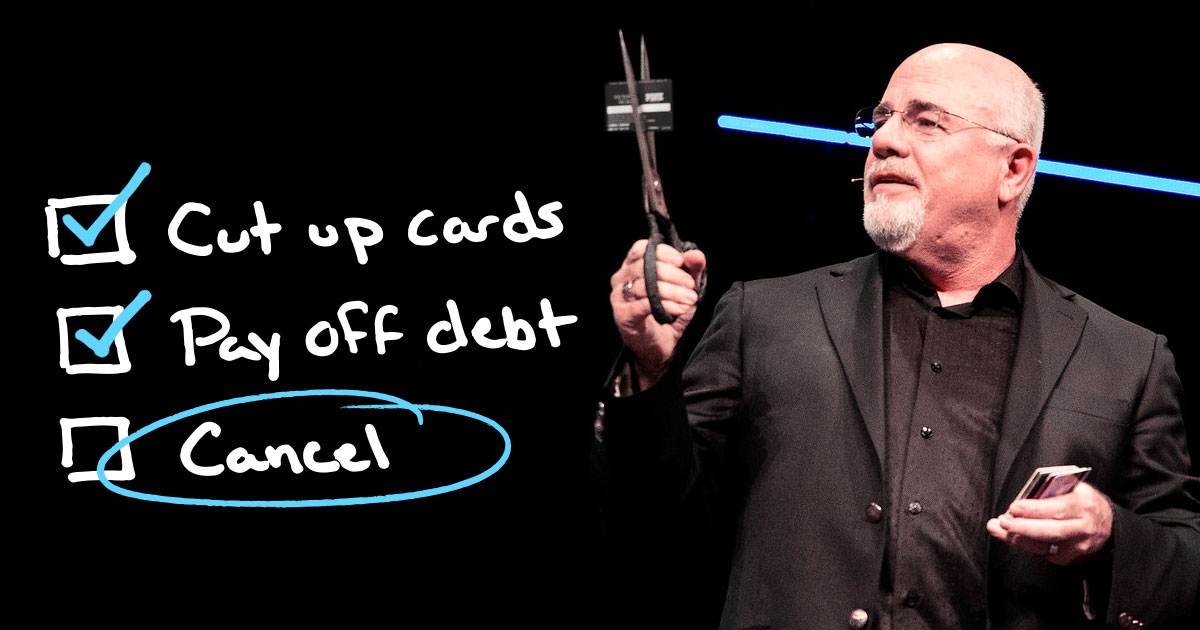

Ready to make some money moves and ditch those credit cards once and for all? Good call. The best credit card is one that’s been cut up and is on its way to the incinerator once and for all.

But just because you’ve cut your cards into smithereens and vowed never to use them again doesn’t mean they’re gone for good. Yep, you’ve got to close your accounts. The process is pretty simple, but if you turn to the wrong source, you’ll get conflicting advice.

A simple google search of “how to cancel a credit card” will land you right smack-dab in the middle of confusion. Turns out, many people will try to tell you that closing a credit card is the worst decision you could make. Don’t worry—they’re wrong.

Here’s the right way to cancel your credit card accounts—no nonsense added.

How to Cancel a Credit Card

Ready to say goodbye to your credit cards once and for all? We couldn’t be any prouder. But now that you’ve cut those puppies up, it’s time to close the accounts—every last one. Ready? Don’t turn back now . . . You’re on track to freedom.

Take control of your money with a FREE Ramsey+ trial.

Here are four steps to canceling your credit card—with ease:

1. Pay off your card balance.

Hopefully you’ve already done this, but just in case, we’ll tell you again. Pay off that card balance! You won’t be able to officially close your account until you have a zero balance.

Of course, you can cut up your credit cards any time you want. A lot of people cut theirs up before the balance is paid, especially if they’ve finally realized what their spouse has been trying to tell them all along—that they might have a bit of a spending problem.

Regardless of why or when you cut up your card, we’re proud of you! Just remember to pay it off so you can close it for good!

2. Call the credit card company.

Closing your credit card can either be a breeze, or it can be a bit tricky. Either way, it’s worth your time and effort to officially close the account. But be ready to stand your ground because credit card companies really don’t want to lose your account.

So, get out that smartphone and call your card’s customer service. Let them know you and your credit card account are breaking up. (You don’t have to use those exact words, but feel free to get creative here.)

Here’s a word of warning: The customer service rep won’t let you off the hook easily. They’ve been trained for this very moment—and they’ll do all they can to keep you on the line so they can try to change your mind.

If that’s the case, just stay calm and repeat, “I’m calling to close my account.” And that’s all you have to say! Not even another word. Listen, they’re going to say whatever they can think of to keep you from closing your account. But don’t fall for these gimmicks:

- You’ll lose all your hard-earned reward points.

- Your FICO score will never be the same.

- No more cash-back bonuses for you.

Once they realize you’re not picking up what they’re putting down, they’ll probably try to win you over with some freebies like:

- We’ll give you 5,000 airline miles.

- What if we waive your annual fee?

- How about no fees?

Whatever you do, don’t fall for it. They’re not trying to shower you with gifts. They’re trying to keep the thousands of dollars in revenue you represent, because when they see you, they see dollar signs. So be prepared. You might have to fight (kindly, of course) to close your credit card account.

If you don’t seem to be getting through to the person on the other end, don’t be afraid to ask for their manager. Keep letting them know you want to close your account. Eventually, someone will catch on to the fact that you’re not to be bribed and will finally close your account.

3. Get it in writing.

Here’s the most important part: Get it in writing! No matter what you do, you want written confirmation from the credit card company that you closed your account.

And keep your own record of the conversation too. Be as detailed as possible and remember what your English teacher said: Who, what, when, where and why. Recording these details will come in handy if the credit card company gives you any trouble down the road.

Use your notes to write the credit card company a certified letter with the details of your conversation, including date, time, names and any confirmation numbers you received. Make sure to request a written statement that shows your balance is all clear and your account is completely closed.

4. Never look back.

Congratulations! We’re patting you on the back right now. While others are keeping old accounts open to “save” their almighty credit score, you’ve taken a huge step on the path toward being free from debt for good.

So, what now? (We’re so glad you asked.) If you have more credit cards, it’s time to scroll back up and repeat the process. Call your friends and family and lead the way in showing them how to close their credit card accounts too.

Top Questions About Closing a Credit Card

Can I cancel my card online?

Great question. In this digital age, it only makes sense that you’d be able to close your credit card account with a few clicks, right? But not surprisingly, most credit card companies want to make it as hard as possible for you to close your account. So many companies don’t offer that option. But every credit card company is different, so it doesn’t hurt to check their website for an online option. If they don’t, the four steps we walked through above will work every time. And either way you go—get proof in writing from the credit card company that your account is closed.

Is it bad to cancel a credit card right away?

Listen: Canceling a credit card is always the best option. So, if you signed up for a brand-spanking-new card and decided it was a terrible decision—you’re right. Closing a credit card soon after signing up will probably put a small dent in your credit score though. Why? Because you’re not playing credit card companies’ “game.” In this world, the more debt you have (and prove to play well with), the better your score. Weird, huh?

How does closing a credit card affect my credit?

Like we said above, closing a credit card will probably affect your credit. Credit scores are based on how well you handle debt. So, when you choose to get out of debt and cancel your credit card, you’re choosing not to play the game. That means your score will decrease (but only for a little while).

Is it better to let a credit card expire or close it?

Again, it depends on who you ask. If you ask the credit reporting systems, they’ll say it’s always better to keep your credit card account open for as long as possible. Somehow, (even if you’re not using it), keeping your card open shows that you’re responsible with credit. If you let your card expire, you probably won’t get penalized for it. But if you’re not going to use credit, what do you need the account for? Yep—it’s time to close that thing for good.

How to Get Rid of All Your Debt

Now that you’ve gotten a taste of what it’s like to shake off that credit card debt, it’s time to tackle the rest. You’ve got to attack all your debt until it’s completely gone. Decide right now that you’ve had it with debt. Yup—we’re talking about student loans, personal loans and even those buy now, pay later schemes. But how?

Glad you asked. Here are a few tips to help you get started:

- Start doing a regular budget. It will put you back in the driver’s seat with your money (where you belong). But we don’t want you to start just any budget. It needs to be a zero-based budget where your income minus your expenses equals zero. And if you’re not sure how to start, EveryDollar can help (and it’s free).

- Tackle your debt with the debt snowball. List all your debts from smallest to largest—regardless of interest rate. Then, pay the minimum payment on everything but the little one, and attack that one with everything you’ve got. (Throw as much money as you can toward it.) When that one is gone, put that payment toward the next-smallest debt. Repeat the process until your debts are completely gone.

- Follow the 7 Baby Steps to freedom. Paying off all your debts isn’t for the fainthearted. You have to get angry at them. You have to get mad. And then you have to work hard—harder than you’ve ever worked to free yourself from those heavy chains. But you don’t have to do it alone. The 7 Baby Steps are here to guide you along your journey from living paycheck to paycheck all the way to living and giving like no one else. Check them out here. And you can learn about this and more in Financial Peace University (exclusively available with a Ramsey+ membership).

Listen, we know that closing your credit card can be a hard decision. Why? Because the almighty FICO wants you to think you won’t be able to live a normal life without a credit card (and an amazing credit score). But who wants normal? The fact is, debt is a trap. And credit cards are the bait.

When you close your credit card accounts, you’re taking the first step down the road to weird—a life free from debt.